SmartDetect

Challenges

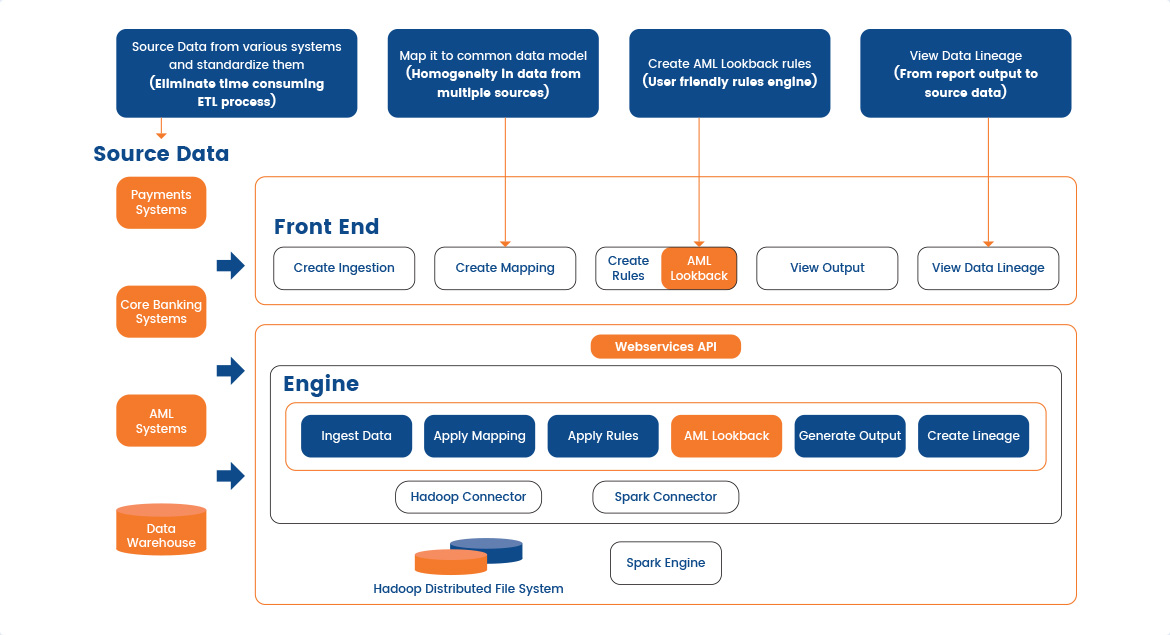

SmartDetect – Pro-AMLytics is HEXANIKA’s Solution For Monitoring, AML Reporting & Fraud that leverages Artificial Intelligence (AI) and Big Data to improve risk detection and mitigation. Built leveraging the SmartJoin platform, the solution validates data to create look back of suspicious activity alerts, create rules to organize and normalize data and provides detailed analysis and communication of results.

Global industries have paid 27+ B in fines for non-compliance with Anti-Money Laundering (AML), Know Your Customer (KYC) and sanctions regulations since 2008. These fines are despite institutions (financial and healthcare primarily) spending significant amounts to manage their adverse event detection and transaction monitoring processes.

With rising compliance pressures from government agencies and constantly changing requirements, the challenge for most institutions is maximizing the effectiveness and efficiency of fraud / adverse event detection while keeping costs in check.

Need a solution for effectively managing AML risks and reports?

Understand how SMARTDETECT ProAMLytics can help your business

Challenges

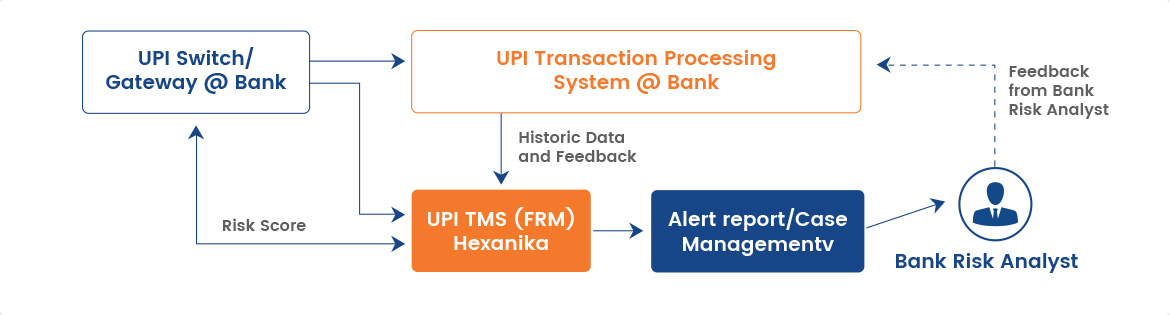

SmartDetect – FraudCheck is HEXANIKA’s offering for transaction & UPI fraud that leverages the power of Artificial Intelligence (AI) and real-time analytics using smart rules engine to detect and mitigate frauds effectively and efficiently. SmartDetect – FraudCheck enables financial institutions globally to easily create rules and checks to analyse and mitigate frauds real time.

Digitization and technology have enabled customers to gain easy access to multiple ways of performing banking and other financial services. However, due to the addition of multiple ways to perform financial operations, the number of frauds has risen significantly. According to a report by Federal Trade Commission 2019:

- 1.4 million frauds were reported and $1.48 B frauds occurred in 2018

- 43% of the victims were people in their 20s

- $423 million frauds occurred through wire transfer

Challenges

Pharmacovigilance focuses on drug quality, medication errors and adverse drug reactions which impact the health care system by affecting a significant patient population. WHO defines pharmacovigilance as “the science and activities relating to the detection, assessment, understanding, and prevention of adverse effects or any other medicine-related problem”.

Pharma Companies must conduct a comprehensive drug safety and pharmacovigilance audit to assess their compliance with worldwide laws, regulations, and FDA guidance. However, there are several challenges with this audit as:

Case Prediction / Adverse Event Reporting To FDA For Healthcare And Lifesciences Industry

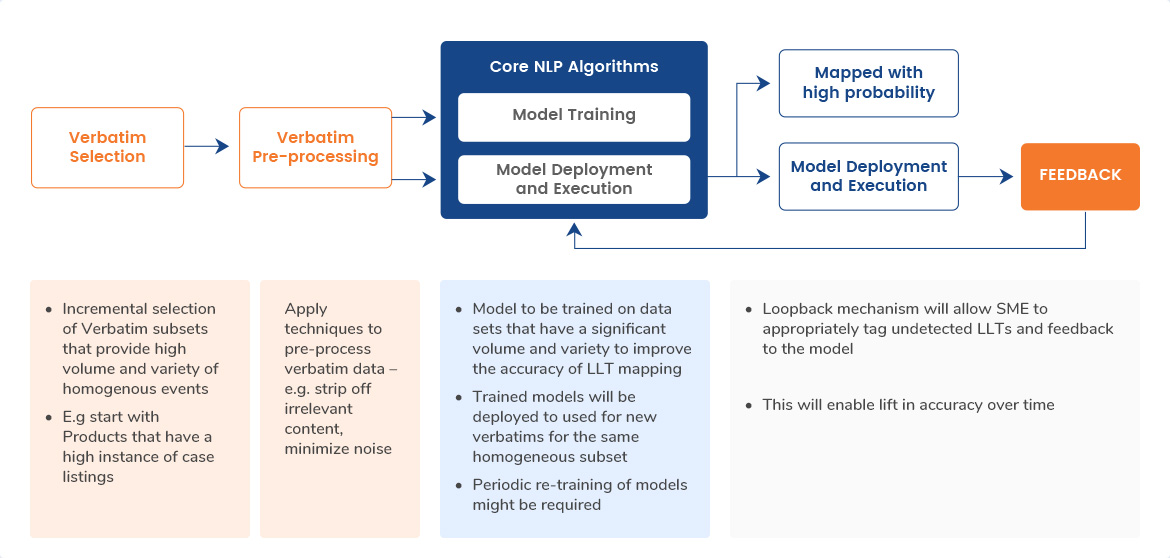

HEXANIKA leverages SMARTDETECT’s Natural Language Processing (NLP) algorithm to predict the Lowest Level Term (LLT) for input verbatims provided by a healthcare firm.

Features