HEXAdecimal, represents a simplification of the computer’s binary language (010101) and raw data into human-friendly representation (ABCD123)

Company Profile

NIKA is Greek “Goddess of Victory”

“HEXANIKA” means victory over data. We enable “thinking beyond data’ by removing all the bottlenecks in the middle of raw data and solutions.

Who We Are?

Outcomes Delivered

HEXANIKA Product Overview

Solution Marketplace For Industry Specific Solutions

- Banking / Financial Services / Insurance (BFSI)

- Life Sciences, Pharma and Healthcare

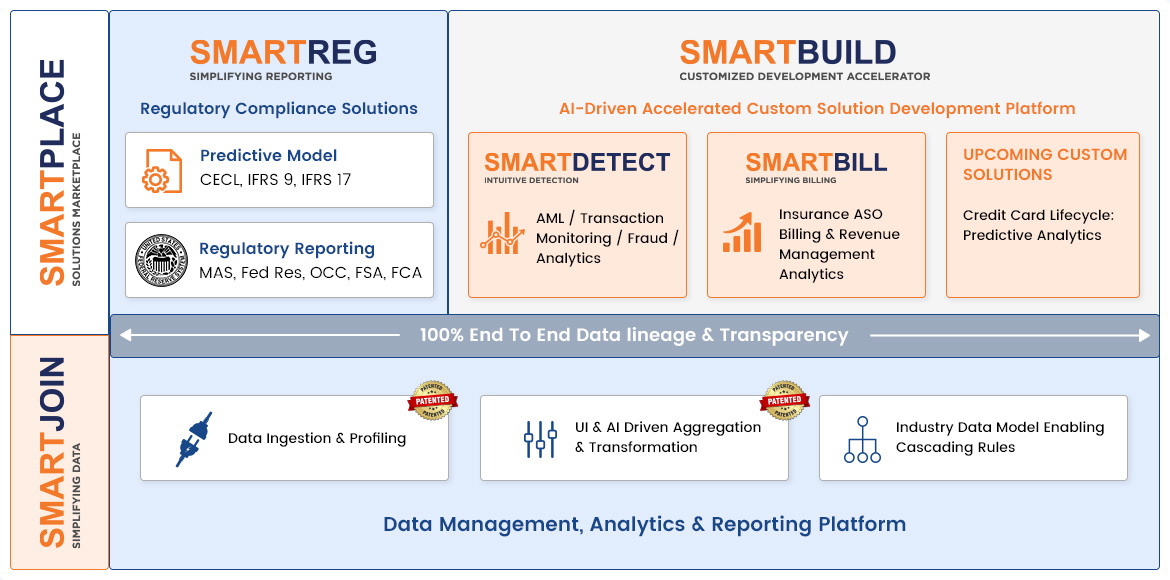

On top of the SMARTJOIN platform, HEXANIKA and, its clients and partners have built solutions that provide business outcome. The solutions come with pre-built data model, rules and reports. These solutions are envisioned with the approach to make adoption and adaption

SMARTPLACE empowers HEXANIKA’s clients and partners to access out-of-the-box AI-enabled solutions with the ability to reuse data and rules using the Cascading Data Model and Pre-Built Rules Engine.

Easy deployment within current architecture

Easy deployment within current architecture