4 Challenges Financial Services Face While Implementing a Data-Driven Approach

Think human, act digital is how start-ups are activating data-driven orientation. It is argued that data-driven organizations that integrate data, human abilities, and proactive management are more effective in innovation.

Startups started stirring up a data-driven orientation. These are the startups that are now perhaps the top five or ten companies in the world, and we’re talking about Google. Yes, Google was a startup 20 years ago. It’s a search engine but mind well, Google makes money on data.

The second startup is Facebook. Yes, it’s a great networking application and solution, but Facebook makes money on data too. If you think about even the phone providers or any other top companies, whether it’s Apple or any other firm, they are all focusing on data. Recently Apple made a significant investment in a company that is focused on data in financial services.

You will see this trend across the industry, whether it is a new startup with a couple of people or whether it is a startup that now has become one of the largest organizations in the world. It is all about data.

There used to be a phrase called “Data is the new oil” which now is becoming aged. If you see what is happening in financial services, particularly the institutions that are focusing on monetizing data are essentially becoming successful.

Traditional institutions that are not focusing on data as one of the key pillars for their growth, their revenue, or key pillars for optimization, are failing “

- Despite the increasing need for data to become more efficient, companies continue to struggle to implement a data-driven approach.

Focusing very much on financial institutions, particularly community banks and credit unions, here’s a holistic reply for the same:

- Culture: Banks have been built with relationships and they’re part of a community. People know each other, and they have been used to building businesses purely based on relationships and most of the community banks had the data of their customers. But as culture and technology are changing, the way to grow is not just by depending on traditional ways of doing business. That’s where data-driven marketing, data-driven compliance, data-driven sales, and data-driven transformation come into play. You cannot have a digital transformation today without data being one of the key pillars. And that’s why if you really see the trend, the fintech companies, which are the new startups by your definition, or companies like Apple or Google or for the metal PayPal or Amazon, these companies are slowly venturing into the space of the financial services.

- Technology: Traditionally smaller institutions, particularly, were all dependent on their service providers. These service providers were built purely as software companies but building software with just Java and net versus a data-driven organization, data-driven software, or keeping data as a focus is completely different. For example, it is like a company is great at building cars with gas engines, diesel engines, or petrol engines but now they have to build a car on batteries and that is a different approach. So, the technology, the framework, and everything to be used for data-driven enterprise is completely different hence technology plays a completely important role in this place.

- People: People have been used to building, servicing, and maintaining cars on traditional engines, whether it’s gas engines, petrol engines, or building cars on batteries. Maintaining cars on batteries is a completely different approach and people have become the biggest roadblock. We’ve got responses when we say that “whatever you are going to do in nine months can be done in three months”, or we are saying that you don’t need to add all these data engineers to have a data program, you can do it self-service way. These are so shocking to various people thus becoming a big problem.

- Process: Large banks are so entangled in their processes that they have spent not just millions but billions of dollars. The processes sometimes are very complicated and especially for large enterprises, it’s very difficult to change.

So those are some of the challenges: Culture, People, Processes, and Technology. It is not any different from any other innovation but that is primarily a problem when it comes to building a data-driven organization.

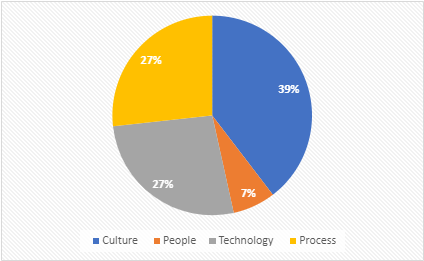

- Below you will find the results of a poll we conducted – We asked our audience about their greatest challenge when adopting a data-driven approach

A majority of votes (39%) were cast for culture whereas there was a tie between technology and process (27%). Among voters, people are considered the least problematic challenge, accounting for 7% of their votes.

- The market is ruthless and is becoming more competitive so if you want to be alive in today’s world, especially artificial intelligence-driven world, you cannot have an approach or a system that is not data-driven.

Conclusion:

AI-based systems can help banks reduce costs by increasing productivity and making decisions based on information unfathomable to a human agent. Also, intelligent algorithms are able to spot anomalies and fraudulent information in a matter of seconds. Faster access to finance for less qualified customers, combined with the opportunity of getting access to finance at a slightly reduced cost, will open up new opportunities for individuals to both reduce indebtedness and improve financial stability.

#DataDriven #DataDrivenEnterprise #Technology #Culture #People #Banks #DataDrivenBanking #CommunityBanks #CreditUnions