CULTURE AS A BARRIER TO DATA-DRIVEN ORGANIZATION

The practice of data culture is to move away from traditional models of management and toward database decision-making. The clear opportunity right now is leveraging data and perhaps expanding the market or expanding the wallet share of the client and that all can be done with data.

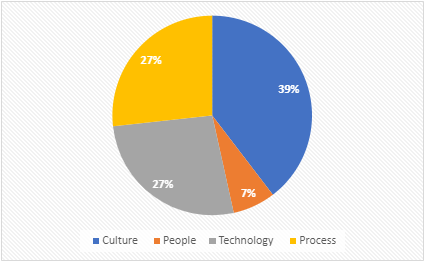

Based on the survey Hexanika recently conducted on this topic, culture was considered the highest barrier in the survey by the executive.

- Following

are some of the reasons why financial service executives consider culture a

barrier to a data-driven approach:

Data appears to continue to be an important subject of discussion among large financial institutions as well as the mid-size or smaller institutions such as community banks and credit unions as well. Now, independent of the size of the organization, it appears that culture remains a roadblock based on the survey that we have done. There are two aspects of it:

- From the Viewpoint of Large Financial Institutions-

- Data-driven is not anything new for large financial institutions. They have been doing marketing using data and performing various other functions. The financial institutions have had to and still have to work on fixing their data challenges. But if you look at large institutions, they did whatever they could based on the technology that they had. And the issue that the large banks have is that whatever they have adopted in terms of technology that was available when these changes happened, those technologies have like in a very fast-paced become problematic for having data-driven approaches. But as the survey said, It is not the technology that is not ready to change. It is the people who are used through traditional data warehousing concepts, and traditional processes who have built this just because there is a need for a fix. They never build these infrastructures and that makes a huge difference.

- Data is something that we can use to improve our bottom line and top line. When you start thinking culturally that way, then the way you will build technologies, the changes that you may have to make in the processes and technologies that you have built in the last 10-15 years, primarily it has been there for the last 20-25 years databases and data warehouses or now the last ten years data Lakes which are on-premise or in the cloud environment. So the whole landscape has changed but what has not changed and there is a huge resistance that I feel is the people although technology is available people still want to do things in a traditional way they still want to operate in a traditional way that is resulting in the financial institutions not being as efficient and effective and that needs a whole cultural change. It needs a view that data should be at the forefront. If you look at the fintech companies that are getting into financial services or if you look at the new tech companies like Facebook, Apple, and Amazon, they all have their payment services and procure services. If you want to compete with the fintech or the new tech banks, you have no option but to consider data as an opportunity than just putting systems and technology on top of it because it’s a problem that needs to be addressed.

- From the Viewpoint of Community Banks, and Credit Unions:

They never had data as a big problem until recently they never looked at data as an opportunity and their problem is because they do not have the capabilities of data science and skillset to adopt the technology.

Today when you say data-driven artificial intelligence is part of a data-driven approach if you cannot have a data-driven approach without even thinking about how you can use AI for optimizing the data that we have and for that these institutions are getting into data but what are the business objectives that these institutions want to solve? Culture will continue to be a problem because once culture changes then only technology changes.

- WHY DOES A DATA-DRIVEN CULTURE MATTER?

If you look at the top companies in the market today, they are all data companies. Google is a search engine but they make money on data yet they don’t promote it as a data company, instead, they promote themselves as a Gmail service, search engine, and chrome browser’, but what are they capturing? They are capturing and monetizing data! Facebook, promote itself as ‘connecting people, etc., but what are they capturing? They are capturing data.

a) Financial services need to realize that they have so much data about their customer that they can influence their decision making, help and connect with their customer with the data that they have. The regulators also want the same data instead of using this as a cost driver which is the way financial services are looking at data right now to possibly convert that into revenue and opportunity. Right now, it is not an option because the new fintech companies are built based on data as an opportunity and are already used to leveraging data as their opportunity and optimizing more and more on it.

b) Financial services did not build their technologies, processes, and people as data as an opportunity, they build all this as data as a problem that needs to be changed, and once that happens then they will be able to compete effectively with these techs and fintech companies.

- How to foster a data-driven culture?

There is no technological answer to it. The board and the management of the financial institution first have to decide that they want to build this as a data-driven company.

- It starts with having to identify some of the immediate opportunities that they may have internally, state the goal for this year and how data can be used to achieve this goal or this is the challenge and how data can be used to solve the challenge. The costs are going up and can they use the latest technologies around data that can reduce that? So for around every ten questions, perhaps these two or three problems can have a data-driven approach.

- Normally the end goal is to increase the bottom line and that is the way to do it. And having that thinking from the top to bottom is very important. Now, culturally, if you say “there is a fear that I may not even have these resources, and the data and may not get the right results”, you need to remove those fears and talk to the right people in the industry. We are here to help you at marketing@hexanika.com. Just shoot an email and we’ll get to you.

So, adding the executives to remove the fear, they need to learn what the fintech and the new techs are doing, observe how firms like Rocket Mortgage, Lending Tree, and others can go into that zip code and how do you make that happen? With the data-driven approach, there are ample opportunities, ample scope, and a new way of technology and managing it.

“Data is the new oil” was a statement almost ten years ago which is now it is an old statement. If you’re not thinking about it and you’re not prioritizing data as an opportunity to drive your market value, customer value, and to drive your overall value of the organization you cannot get the desired results. Have the right culture and you will optimize it.