AI In Regulatory Compliance: If You Are Not In, Then You Will Be Out!

Learn about the top 4 trends and the top use cases of AI in regulatory compliance for financial services. Understand how AI can give a competitive advantage in a data-centric world.

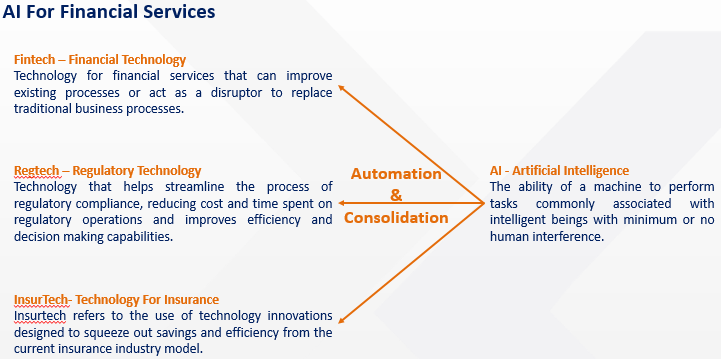

Businesses today have many innovative technologies such as Artificial Intelligence (AI), Machine Learning Algorithms, Python, Big Data, and other options that can automate regulatory compliance and business processes. Automation driven by Artificial Intelligence (AI) has picked up trend since 2019. Only 20 % of companies surveyed have plans to incorporate AI throughout their companies in 2019. If the financial institutions choose not to adopt AI now, they’ll lose a significant competitive advantage.1 Startups in the FinTech, RegTech, and InsurTech sectors have been the pioneers in enabling this adoption, especially for the small and midsize institutions.

Top 4 Compliance Industry Trends

1.Compliance Cost Is Increasing

According to Accenture’s 2018 Compliance Risk Study, compliance can no longer depend on adding new resources to increase effectiveness. 89% of the respondents from over 150 compliance officers at banks, insurance companies and capital market firms globally, indicate an increase in compliance spend in the next two years. According to a survey by Duff & Phelps, compliance costs in the financial sector are on pace to double by 2022. The current spend on compliance and regulatory obligations is $270+ billion per year.3 Despite this high spending and resources, banks had to pay $342 billion in fines between 2009 to 2017 – with some big banks fined in excess of $1B each.4

The focus of this spending is shifting from people to technology. This shift indicates a rise in trust that new technology can help institutions realize high returns in the future. However, there needs to be a planned approach and understanding of the effective deployment of the RegTech solutions to gain value and benefits.

2. Managing & Understanding Regulatory Changes Needs Streamlining

Regulatory scrutiny has increased significantly since the 2008 Financial Crisis, but a decade later, the pressure is still high for various key industries. More than 750 global regulatory bodies are pushing over 2,500 compliance rule books and giving rise to an average of ~201 daily regulatory alerts.5

However, with changing regulations, financial institutions are facing a growing challenge to keep up with the pace and make sense of the new regulatory changes and how they affect them. According to the 2018 Compliance Pulse Report, 64% of the respondents (comprising Compliance Officers, VP, Executives, and others) feel they do not have enough time to manage all their compliance needs, while 1 in 3 respondents say that the most pressing issue in compliance is staying up to date on regulatory changes.

Adopting innovative technology such as AI will significantly benefit institutions not only to manage changes to regulations but also to leverage existing data to stay compliant and gain insights.

3. Data-Centric Strategy for Compliance

Data is the core of regulatory compliance. Regulators have identified that various lapses in reporting are due to weak data and reporting processes. Thus, BCBS 239 principles were introduced that provided framework to institutions around data governance and infrastructure, risk data aggregation and risk reporting. As per Lourenco Miranda, Managing Director at Societe Generale “If you can’t uniquely and precisely provide data with the granularity the Fed expects, you won’t be able to produce the capital forecasts as you should”.6

Regulatory bodies expect banks to provide end-to-end data lineage i.e., the ability to track data from its source to the report. Managing and maintaining this data lineage as data goes through multiple systems and software is challenging. 31% of institutions feel data quality issues were the key barriers hindering their organization’s progress and effective delivery for compliance.7 Analysts today are spending 90% of their time on data collection and organization, and only 10% on data analysis.8

Adoption of Big Data and AI technologies can significantly enhance and enable data-centric compliance by providing automation and consolidation of regulatory compliance processes, and also enable analysts to maximize time for data analysis and minimize that for data collection.

4. Reactive To Proactive Compliance

Thanks to technology advancements and a cultural shift in financial institutions and large industries, data analysis and reporting is no longer seen as an obligation but an opportunity to understand trends and better mitigate inherent risks. Driving the change is also a heavy burden on institutions to bring down costs while adopting innovation in order to stay ahead of the competition.

New regulatory regimes could see a more proactive approach to regulations, where regulatory processes can be streamlined to such an extent that periodic regulatory reporting will be a thing of the past, as regulators can get real-time data access and compliance checks are made on the fly. With technology like Apache Spark, real-time data analysis and monitoring is easily available to financial institutions, who. can define necessary fields to monitor their data, as granular real-time analysis of data can significantly reduce the reaction time to identify and track fraud.

This proactive approach to compliance will need an end-to-end platform for data collection and mining, with in-built compliance features that can automate regulatory processes and allow real-time identification of risk/fraud. Automation and consolidation of reporting and analytical processes can significantly help in enabling this streamlined approach to regulations.

Top Regulatory Compliance Use Cases

3 Ways AI Can Add Value: Simple, Smart & Efficient

1. Make Regulatory Compliance Process Simple: Automating Repetitive Manual Tasks

Regulatory compliance processes are largely focused on collecting data from various source systems, cleansing the data, and checking it for accuracy before submitting it to the regulator in the mandated format. This process requires several manual interventions and repetitive processes that can rather be automated using the power of AI. Automation and consolidation can significantly bring down the time and effort required for compliance while also minimizing manual errors.

2. Make Regulatory Compliance Process Smart: Better Decision-making

The biggest value of using AI is its ability to understand and predict patterns in risk, data management, and gain insights on the data. Banks must adopt a data lake architecture to store data coming from multiple data sources and deploy a real-time analytics engine for a good patterns-recognition solution capable of tracing hidden risks. This technology can be used to comply with various regulations such as financial crime, money laundering, fraud (AML, MiFID II, FinCEN) and others.

3. Make Regulatory Compliance Process Efficient: Significant Savings

Advancements in Big Data, AI, and Cloud have enabled institutions to automate processes and solution workflows that previously required dedicated human intervention. Additionally, FinTech firms are offering easy adoption models like Software as a Service (SaaS) and/or implementations working directly with existing systems within the institution. This flexibility along with the benefits derived by AI automated solutions are making regulatory processes simpler and more value-driven.

In the Accenture Technology Vision survey, nearly half of the financial institutions indicated that they have achieved 15% or more in cost savings from automating systems in the past two years. Some institutions report reduced costs by up to 80% and time to perform tasks were reduced by up to 90%. AI-based regulatory solutions have also showcased improved capabilities in keeping a check on local regulatory changes and controls, while also providing increased data quality, thus reducing human errors.

Conclusion

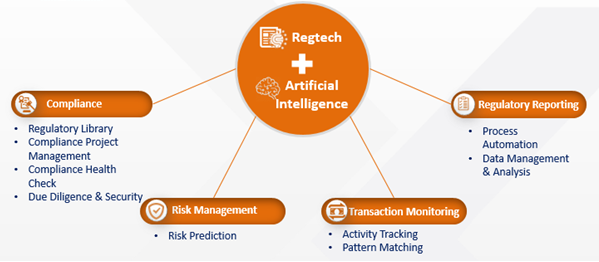

The power of AI in RegTech can be leveraged to automate and consolidate inefficient and ineffective manual processes in Regulatory Compliance, Reporting, Risk Management and Transaction Monitoring. AI-powered regulatory solutions enable banks to not just get higher Roi but also free up resources for customer-centric activities and make the processes simple, smart and efficient. AI is ready to be harnessed, and this is the time to adopt. There are many prebuilt AI solutions available in the market that can accelerate this adoption. It’s time to automate data management and reporting for risk and regulatory compliance. If cars can drive themselves, so can regulatory compliance!

Author

Contributors:

Thank you for your excellent & informative articles

- Guy Hammon

- Daniel Newman

- Steve Culp

- Steven Marlin

- Jill Treanor

- Lucy McNulty

References:

- https://www.fisglobal.com/-/media/fisglobal/files/pdf/white-paper/regulatory-compliance-and-regtech-opportunities-abound-in-2019.pdf

- https://www.forbes.com/sites/danielnewman/2018/12/21/top-six-ai-and-automation-trends-for-2019/

- https://gomedici.com/regtech-the-greatest-opportunity-in-fintech/

- https://www.forbes.com/sites/steveculp/2018/03/27/how-the-compliance-function-is-evolving-in-2018-five-key-findings/

- https://www.theguardian.com/business/2016/sep/16/deutsche-bank-14bn-dollar-fine-doj-q-and-a

- https://www.risk.net/risk-management/5781976/regulators-bristle-at-slow-progress-on-bcbs-239

- https://www.fnlondon.com/articles/compliance-costs-to-more-than-double-by-2022-survey-finds-20170427

- https://www.accenture.com/us-en/insights/financial-services/2018-compliance-risk-study-financial-services

- https://www.accenture.com/no-en/insight-financial-services-robotic-process-automation