Real-Time Data Processing: Embracing AI and Big Data for Agile Decision-Making

Over the span of several decades, the banking industry has undergone revolutionary changes, continually adapting to the latest technological innovations to redefine the way customers interact with financial institutions. From the introduction of ATMs in the 1960s to electronic card-based payment systems in the 70s, debit and credit cards revolutionized transactions, paving the way for cashless economies. The 2000s saw the rapid expansion of the Internet and the broad adoption of 24/7 online banking. While the 2010s witnessed another paradigm shift with the widespread embrace of mobile-based “banking on the go.” Smartphones became ubiquitous, and banks capitalized on this technology to offer intuitive mobile apps and responsive websites. Customers could now perform an array of banking tasks while on the move, from depositing checks using their phone cameras to receiving real-time transaction alerts.

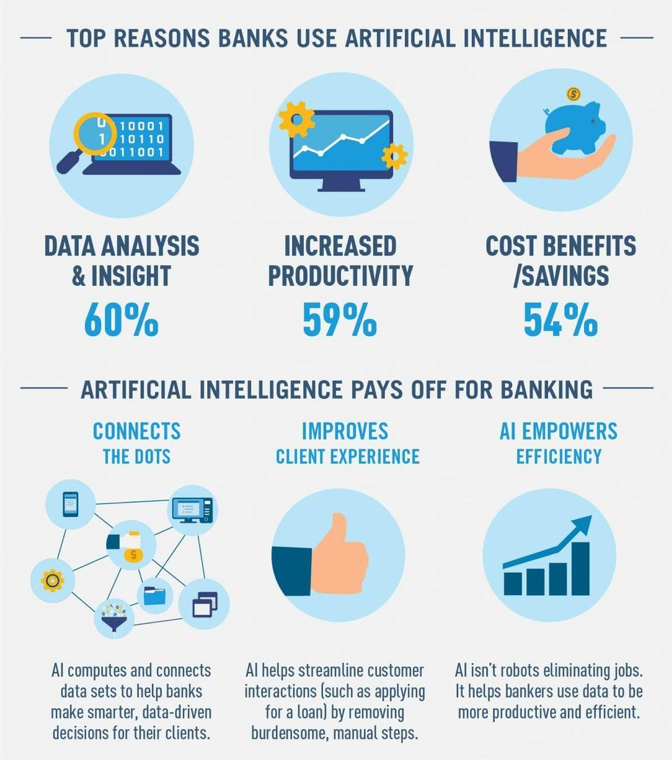

Today, we find ourselves in the AI-powered digital age, a result of the convergence of falling costs for data storage and processing, increased accessibility and connectivity for all, and exponential advances in AI technologies. Artificial intelligence and machine learning hold immense potential to revolutionize banking once again. By leveraging vast amounts of customer data, AI can offer personalized financial advice, detect and prevent fraudulent activities, and streamline back-end operations, leading to more efficient and cost-effective banking services.

The transformation of work structures and the integration of modern technologies have resulted in an exponential surge in data production within the banking sector. Moreover, the characteristics of this data have undergone substantial evolution. Considering these changes, shouldn’t the approach to data analysis also be adapted accordingly?

Well, the answer to this lies in adapting a real-time data processing approach to navigate through modern-day data challenges and increase operational efficiency and profitability.

In fact, many banks are planning to deploy solutions enabled by AI: 75% of respondents at banks with over $100 billion in assets say they’re currently implementing AI strategies, compared with 46% at banks with less than $100 billion in assets, per a UBS Evidence Lab Report.

What is Real-Time Data Processing and Why Does Your Organization Need it?

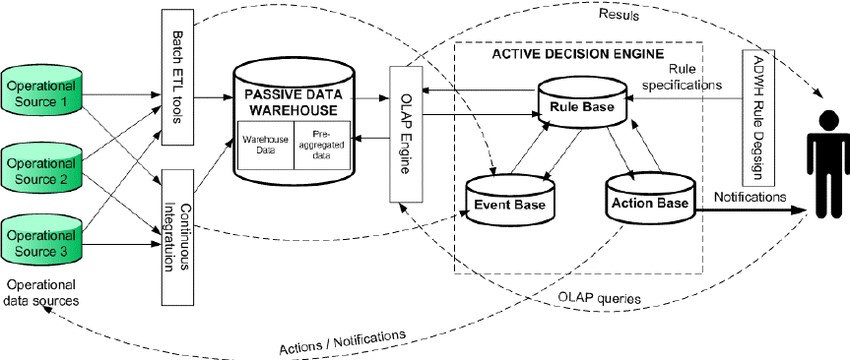

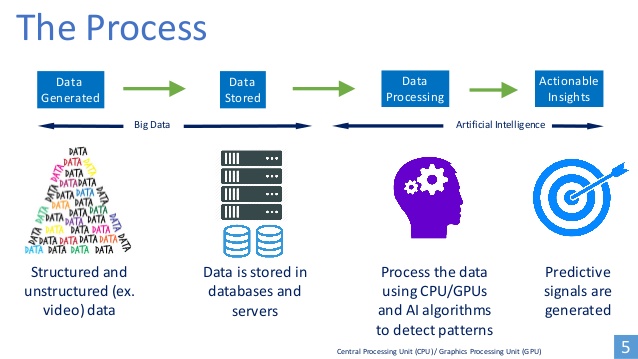

Real-time data processing refers to the immediate and continuous analysis of incoming data as it is generated or received, enabling organizations to respond swiftly to events and make data-driven decisions in the present moment. By fusing the power of AI and the vast potential of big data, banks can not only handle information at the speed of thought but also extract meaningful insights that were previously hidden amidst the data deluge.

Implementing real-time data processing holds impeccable significance for banks, and here are the reasons why your organization needs to adopt this approach.

Customer Centricity:

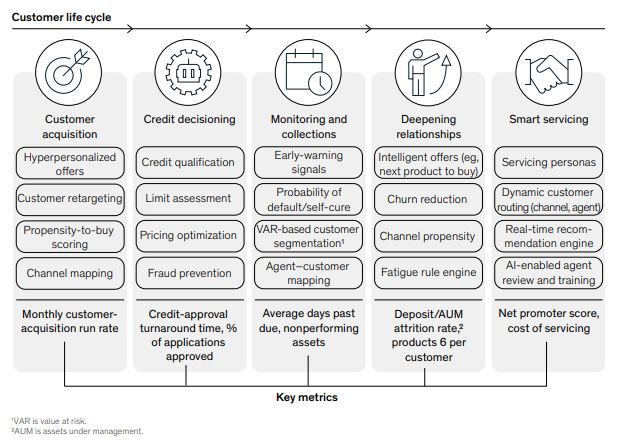

Customer-centricity has become a cornerstone of modern banking, and leveraging AI and ML technologies can immensely benefit financial institutions in this pursuit. Throughout the customer life cycle, from acquisition and onboarding to retention and loyalty programs, banks accumulate vast amounts of data on their clients. One of the most significant advantages lies in the realm of personalized services. AI algorithms can analyze vast amounts of customer data, ranging from transaction histories to online behavior, to discern individual preferences and behaviors. Armed with this knowledge, banks can tailor their offerings to cater to each customer’s unique needs, thereby enhancing customer satisfaction and loyalty. The below figure represents the customer life cycle and how real-time analysis is important for various cases at each stage.

Business Value for Banks:

The aggregate potential cost savings for banks from AI applications is estimated at $447 billion by 2023, with the front and middle office accounting for $416 billion of that total, per Autonomous Next Research. Below are mentioned some benefits of adopting real-time data processing for banks.

- Seizing Opportunities:

- Employing real-time data feeds and algorithmic trading systems to execute trades quickly and capitalize on fleeting market opportunities, enhancing the bank’s position in the financial markets.

- Utilizing real-time customer feedback and market data to identify emerging trends and customer needs, allows the bank to innovate and introduce new products and services ahead of competitors.

- Fraud Detection and Security:

- Implementing real-time anomaly detection algorithms to monitor account activities and detect any unusual patterns that may indicate fraudulent behavior, triggering immediate alerts to the bank’s security team.

- Using real-time authentication methods such as biometrics or behavioral analysis to ensure secure access to customer accounts and prevent unauthorized access.

- Agile Decision-Making:

- Real-time performance dashboards and data visualization tools that provide instant insights into key performance indicators (KPIs), empowering bank executives to make data-driven decisions on the spot.

- Utilizing real-time market data and customer feedback to adjust pricing strategies, product offerings, and marketing campaigns in response to changing market conditions and customer demands.

- Operational Efficiency:

- Real-time tracking of transaction processing times and system performance, enabling the bank’s IT team to quickly identify and resolve potential bottlenecks and issues, minimizing downtime and improving overall efficiency.

- Implementing real-time inventory management systems to optimize cash flow and ensure that ATMs and branches always have adequate cash reserves to meet customer demands.

- Competitive Advantage:

- Using real-time sentiment analysis of customer feedback on social media and customer service channels to identify areas for improvement and proactively address customer concerns, enhancing the bank’s reputation and customer loyalty.

- Leveraging real-time data on competitor offerings and market trends to quickly develop and launch new products and services, gaining a competitive edge in the market.

- Regulatory Compliance:

- Real-time monitoring of transactions and customer data to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, flagging suspicious activities for immediate review and reporting.

- Utilizing real-time data analytics to identify potential compliance gaps and proactively address regulatory requirements before audits or inspections occur.

What’s Holding Back Organizations?

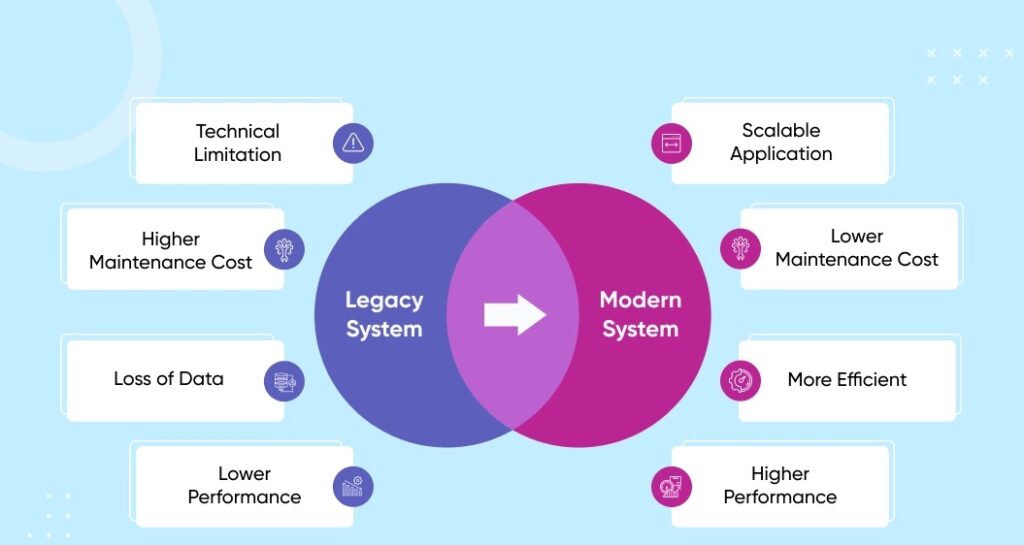

Legacy Technology

As it’s quoted these days, the data is the new oil. Despite this wealth of information, only a fraction of it is currently being efficiently ingested, processed, and analyzed in real time. The root of this limitation lies in the constraints imposed by legacy technology structures, which struggle to keep pace with the rapidly evolving landscape unable to support real-time data processing and analysis efficiently.

Solution- By implementing AI-powered data processing platforms and cloud-based infrastructures, banks can overcome the limitations of legacy systems and harness the power of real-time analytics. AI unlocks sophisticated analytical capabilities, including predictive analytics, machine learning, and natural language processing. Banks can employ these tools to forecast market trends, anticipate customer behaviors, and optimize business processes.

Complexity of Modern Architecture

One major hurdle to improving real-time data processing capabilities is the challenge of seamlessly adopting more modern architectural elements. Integrating new technologies and frameworks into existing systems can be complex and time-consuming, leading to a reluctance among companies to undergo the necessary changes. As a result, they often find themselves grappling with the trade-off between prioritizing speed or computational intensity.

Solution- AI-driven data integration platforms can automatically map and transform data from various sources, simplifying the process of incorporating new technologies. These platforms create efficient data pipelines, ensuring smooth data flow between legacy systems and modern architectural elements. Moreover, AI and big data technologies facilitate the development of low-code and no-code solutions, enabling business users to build and integrate new functionalities without extensive coding knowledge. This accelerates the adoption of modern architectures by reducing reliance on specialized IT skills.

High Computational Demands

Intensive real-time processing jobs place a significant burden on computational resources, further aggravating the problem. Such tasks require substantial processing power, leading to higher infrastructure costs and potential bottlenecks in data processing pipelines. Consequently, even though the potential for more sophisticated analysis and real-time use cases exists, companies are hampered by the limited capacity to meet these demands.

Solution- AI enables efficient data processing through parallel computing and distributed processing, optimizing computational resources and reducing infrastructure costs. This involves techniques such as data shuffling, data partitioning, and in-memory processing to minimize data movement and maximize computational efficiency, leading to faster data processing.

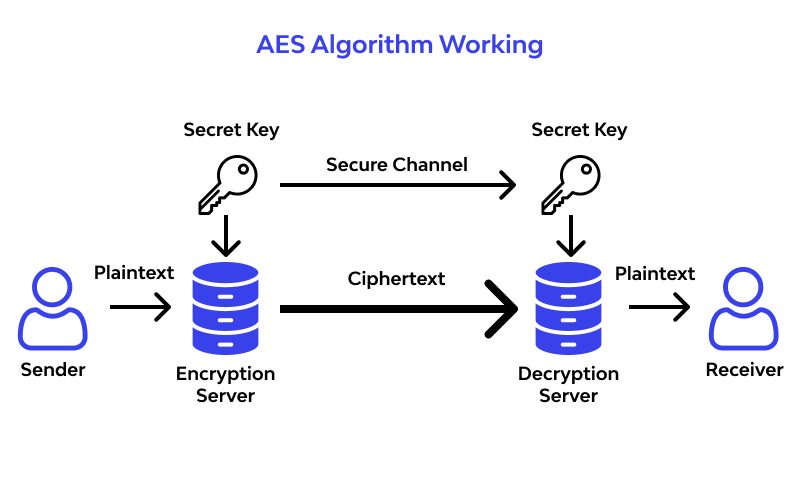

Data Privacy and Security Concerns

With the increasing volume and sensitivity of data collected from connected devices, ensuring data privacy and security becomes a critical challenge. Organizations must navigate complex regulations and implement robust security measures to protect data from breaches and unauthorized access.

Solution- AI can bolster data privacy and security measures through advanced encryption, anomaly detection, and predictive modeling. Machine learning algorithms can continuously monitor data access patterns, detecting potential threats and unauthorized activities to prevent data breaches.

Organizational Culture

Resistance to change and a lack of data-driven culture within the organization can hinder the adoption of new technologies and data-driven strategies. A successful data-driven transformation requires commitment and support from all levels of the organization.

Solution- AI and Bid Data-powered analytics and data-driven insights can be presented in user-friendly dashboards and reports, encouraging a data-driven culture within the organization. By demonstrating the value of real-time analytics, banks can foster a mindset that embraces data-driven decision-making.

Everyday Application for AI and Big Data Technologies in Banks:

- Anti-Money Laundering (AML) and Know Your Customer (KYC): AI-driven pattern recognition and anomaly detection can improve AML and KYC processes, identifying suspicious activities promptly and ensuring compliance with regulations.

- Investment Portfolio Analysis: Real-time analytics enables auditors to monitor investment portfolios continuously. They can assess the performance of various assets, evaluate risks, and recommend adjustments to optimize returns.

- Credit Portfolio Management: Auditors can apply real-time analytics to monitor the creditworthiness of borrowers continuously. This helps in optimizing credit risk management and ensuring the health of the organization’s credit portfolio.

- Monitoring Key Financial Ratios: Real-time analytics facilitates continuous monitoring of key financial ratios such as liquidity ratios, solvency ratios, and profitability indicators. Deviations from expected trends can be promptly investigated.

- Crisis Response and Business Continuity: In times of crisis or unexpected events, real-time analytics supports auditors in assessing the organization’s resilience and response strategies, helping to ensure business continuity.

- Optimized Resource Allocation: By streamlining the audit process and gaining real-time insights, auditors can allocate resources more efficiently. They can focus on high-risk areas or emerging issues, maximizing the impact of the audit effort.

Wrapping Up!

Real-time data processing thrives on speed and accuracy, demanding robust data ecosystems. To design a scalable and agile data ecosystem, organizations must consider a set of criteria, including a holistic strategic vision for data and AI, a cloud-native approach for scalability, a data strategy to reduce complexity and silos, and manageable unit costs for growth.

At HEXANIKA, we help businesses seamlessly integrate AI and big data technologies for leveraging real-time data processing. Our patented technology is based on artificial intelligence architecture and patented AI-based algorithms that automate, consolidate and standardize business processes. HEXANIKA is an automated semantic layer that allows integration with existing frameworks to help convert raw data into actionable and accurate intelligence. Our flagship product #SmartJoin is an end-to-end data management, analytics, and reporting platform, providing self-service data solutions.

Get in touch at marketing@hexanika.com.